Revolutionizing Film Financing with Blockchain!

Increase your allocation by staking more $FINC for longer.

Proportional to guaranteed allocation.

$250,000.00

$0.20

1 FFA =$0.20

Loading...

Balance

Loading...

Invested

Loading...

Remaining Allocation

Loading...

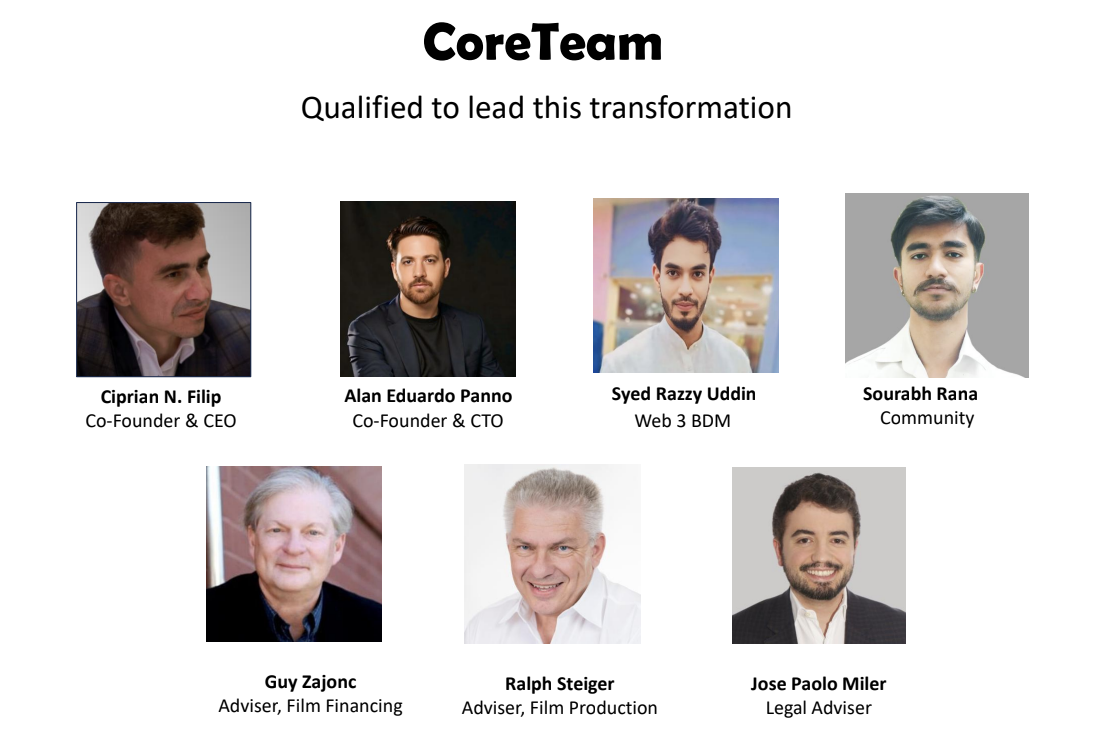

FilmFund is a Web3-native platform that revolutionizes how films are funded, promoted, and distributed. By transforming fans and influencers into active stakeholders, it empowers independent filmmakers to raise capital, engage global audiences, and access distribution — all without upfront costs. Built on a dual-token model ($FFA and $FPP), FilmFund combines decentralized financing, influencer-powered marketing, and AI-driven distribution under a legally compliant framework, ensuring transparency and trust across jurisdictions.

At its core, FilmFund connects three key groups: filmmakers seeking funding and exposure, fans and influencers eager to support and earn from film success, and investors looking for tokenized revenue-sharing opportunities. Through staking, engagement rewards, and AI-based promotion, the platform creates a self-sustaining ecosystem where creativity meets community. FilmFund doesn’t just fund films — it builds a decentralized, community-owned future for the global entertainment industry.

Capital Access Without Barriers: Filmmakers list their projects and raise funds from community liquidity pooled through staked FFA tokens converted into USDC once targets are met.

Influencer-Powered Engagement: Users stake FFA to promote films on social media. An oracle system measures engagement (likes, shares, views) and rewards promoters with Film Promotion Points (FPP), which can be converted into FFA.

Legal & Tokenized Investment: After fundraising, a legally compliant Joint Venture (JV) Token is issued, representing investors’ profit-sharing rights. Filmmakers receive stablecoins or fiat after platform and legal fees.

AI-Powered Distribution: An AI distribution engine helps filmmakers optimize reach, targeting, and campaign performance at no direct cost — only in exchange for FilmFund credit in closing or marketing materials.

The go-to-market (GTM) strategy follows a three-phase approach focused on community growth, strategic partnerships, and data-driven marketing.

In the first phase (2025–2026), FilmFund.io will build early traction across X (Twitter), LinkedIn, and Telegram through collaborations with IBC Group and Web3X. A reward-based referral program using Film Promotion Points (FPP) will engage filmmakers, crypto investors, and creators to strengthen community awareness.

The second phase focuses on onboarding independent filmmakers and production studios across Europe and Asia by offering a transparent, tokenized funding model. Early-stage projects will be featured through JV tokens, enhancing both visibility and engagement.

Finally, the third phase emphasizes scaling and institutional expansion through the integration of Film Liquidity Pools (FLP) and cross-chain access via DEX/CEX listings. Partnerships with distributors, studios, and media funds will help attract institutional liquidity and solidify FilmFund.io’s position as a leading player in film tokenization.

Before you consider participating in any investment opportunities on Finceptor, please take a moment to read and understand the following important information. Investing in cryptocurrencies, Web3 projects, and participating in token sales involve inherent risks you should be aware of.

Risk of Loss: Investing in cryptocurrencies and Web3 projects carries a significant risk of financial loss. Prices of tokens and cryptocurrencies can be extremely volatile and unpredictable. You could lose all or a substantial portion of your investment.

Research: You are responsible for conducting thorough research before participating in any investment opportunity. This includes understanding the project's purpose, technology, team, and market potential. Do not invest solely based on hype or promises.

Regulatory Considerations: Cryptocurrencies and Web3 projects are subject to various regulatory frameworks in different jurisdictions. Regulatory changes could impact the legality and functioning of projects. Ensure you understand the legal implications in your country or region.

Scams and Fraud: The cryptocurrency space has been associated with scams, fraudulent schemes, and phishing attacks. Be cautious of unsolicited offers, and always verify the authenticity of the information and individuals involved in a project.

Unpredictable Technology: Web3 projects use new and advanced tech that might not be fully checked. This could lead to problems and money loss.

Liquidity Risks: Tokens acquired through pre-sales or investments may not have an active secondary market initially, which could limit your ability to buy, sell, or trade them.

Financial Advice: The information provided on our platform, including whitepapers, project details, and investment recommendations, should not be considered financial advice. You should consult with a qualified financial advisor before making any investment decisions.

You acknowledge and accept these risks by accessing and using Finceptor's investment platform. You agree to conduct due diligence and make investment decisions based on your own judgment. Finceptor does not assume any responsibility for your investment choices or the outcomes thereof.

Please remember that investing in cryptocurrencies and Web3 projects can be speculative and involves high risk. Only invest what you can afford to lose.

This disclaimer is designed to inform potential investors about the risks and considerations associated with participating in the Finceptor investment platform. However, it is advised to consult legal experts to ensure the disclaimer is appropriate for your specific circumstances and legal requirements.

Purchasing, holding, and transacting in any way with tokens shall not warrant, commit nor guarantee any revenue, profit, or value appreciation. Purchasing tokens shall not be construed as an investment. Token merely offers utilities and features within the project’s ecosystem and platforms. Finceptor reserves its right to amend and modify the utilities and features offered by the project.

Crypto and crypto assets transactions, including tokens, are very risky regarding potential losses, merchantability, technical failures, and legal and tax requirements. Indeed, the price of crypto assets can even become zero or be excessively volatile. By purchasing and holding or transacting in any way with the token, you agree and acknowledge that you undertake such risks on your own and shall consult your legal and tax consultants for compliance purposes.

We do not provide investment or financial advice, and all projects reviewed are done objectively in accordance with established reporting and information dissemination best practices. Before investing in any Web3-related project, you should conduct your research. As a result, Finceptor is not liable for any losses incurred due to a consumer’s investment decision.